Prologue: Silicon Dreams

In the mid-1990s, the internet was a spark lighting up the world, and I stood at the center of its ignition.

At Pacific Telesis—the venerable West Coast telecom holding company for Pacific Bell—I was charged with managing the physical infrastructure for its emerging high-tech ventures: mobile phones, wireless cable, a state-wide fiber backbone, and finally a network-based voicemail system. As Director of Real Estate and Facilities, I was building data centers, Points of Presence (PoPs), call centers, and storefronts as fast as our engineers could design them. What began with two facilities ballooned into hundreds.

Environmental stability was paramount. Network uptime had to be near perfect. Our engineers had monitoring tools—SNMP traps and remote network management platforms—but alerts often came too late. Over 70% of system outages began in my domain: power, cooling, fire suppression, humidity. I remember roaming equipment rooms late at night, listening for alarms and scanning for blinking red lights. For a while, before I was allowed to hire staff, I was the facility manager myself.

It was during this time that a contractor I worked with, Steve Hunter, and I imagined something audacious over lunch: what if we could connect every piece of environmental equipment to the internet and monitor it all with a simple web browser?

At the time, most of this equipment came with intelligent serial ports—used by technicians on service calls. If we could decode the proprietary protocols and convert serial data into IP traffic, we could build something groundbreaking.

Steve began developing a crude prototype. I bought two units. They worked well enough to start scaling back my 24/7 roaming staff. The idea had legs.

Chapter 1: The Spark

Two years later, I was working in business strategy for a Big Four firm, designing global expansion strategies for tech companies in Silicon Valley. One day, Steve visited me in San Francisco. He had refined the prototype—now ready for broader deployment. He floated the idea: leave the firm, join him, and turn this into a real company.

The internet boom was pumping. San Francisco pulsed with energy—launch parties, new logos on SoMa warehouses, VC-funded dreams flying fast and loose. I was comfortable, but not immune to the fever.

I jumped. We formed NetBrowser Communications with a bank account containing $18,000, a demo unit, and a dream. I became the COO, head of sales, and corporate secretary. We hired Marc Davilla, a super capable sales engineer, and went to work. We built a crude website, crafted data sheets, refined our live demo, and hit the phones. Sales came quickly.

We signed on Pacific Bell, Delta Dental, and a wave of CLECs (Competitive Local Exchange Carriers). We joined Salesforce in their first 1,000 customers to manage our growing pipeline. As the orders grew, we brought in our first head of engineering—Dr. Ujwal Setlur, a brilliant coder.

Money, inevitably, became the constraint. We needed capital to grow.

Chapter 2: The First Fall

Our first major outside investment came from an early Apple product manager, backed by French capital. The deal—literally signed on a napkin in NetBrowser’s conference room —brought in $2 million. I was to hire a full-time head of sales and jump-start marketing and business development.

We moved into a real office.

Like so many Valley startups, the space reflected the times: open floor plans, bean bag chairs, a pool table, ping-pong table, stocked fridge with unlimited snacks and drinks. The energy was electric. We worked late. We laughed. We built.

Then it all cracked.

One morning around 11 a.m., Steve walked into the office and dropped a bombshell.

He told us he had a “talk with God in the shower,” and that God had told him four things:

“His life moving forward as CEO would be prioritized as God, family, and then business—and that business could only take up 20 hours per week max.”

“NetBrowser was to adopt a Christian mission and vision statement, and I, as the COO, would need to distribute the new materials to our team—Muslim, Hindu, Atheist, and Catholic alike.”

“We would begin daily noontime Bible study as a company.”

Also, I was told he had received a vision that our newest and top-performing sales hire was actually the Devil, sent to sabotage the company—and that it was my job to fire him.

I was relatively early in my executive career, but no business school, leadership book, or mentorship experience had prepared me for this. And it didn’t stop there. The workplace began to take on an almost surreal tone. I started recording conversations just to play them back for an outside business coach—to confirm that I wasn’t losing my mind.

We were entering serious legal territory. You can’t fire someone based on religious visions. You can’t mandate religious practices at work. On top of that, business was thriving and every one of us was already stretched thin. We simply didn’t have time for this.

Unless Steve could silence his faith in the workplace and find a way to quadruple his hours, we were going to lose everything.

I called our new chairman and lead investor. He was boarding a plane to Paris when I reached him. I kept my voice calm and steady as I described what had transpired. At the end of the call, I simply said: “We need help. Fast.”

Within two weeks, Steve agreed to sell a sizable portion of his shares to the VC and step away from the business. A new CEO would be brought in immediately.

Chapter 3: The Ascent

Mike, a former lineman for the phone company who had risen through the ranks to lead major teams, was someone I knew from my Pacific Bell days. He wasn’t formally schooled in business—he didn’t even have a college degree—but he was grounded, technically competent, and he knew how to manage. More importantly, he wasn’t divisive. The Chairman believed he was exactly what we needed to reset the culture and stabilize the operation.

Under Mike’s leadership, NetBrowser matured rapidly. We hired up and scaled quickly growing to over 40 people. The team included engineers, client services staff, support reps, marketing help, and a growing install team. Our customer list kept expanding: EMC, WorldCom, SBC, Exodus Communications, Gillette, and a host of data center operators and CLECs. The technology was evolving in real time, and the deals were getting bigger. It felt like the company was finally becoming what we had imagined.

And we were. Ujwal and his engineering team were producing magic. The technology stack was robust and flexible, and we had begun prototyping what would later be understood as embedded agents—software that could reside directly on environmental infrastructure and report back in real time.

But scaling meant burn. And one day, Mike pulled me into a side room and delivered the news:

“We’ve got about a month of cash left. After that, we miss payroll.”

It was an existential moment. We had finally built a real company—and now we were about to run out of money.

We had been on the fundraising trail for months—reaching out to what felt like a hundred venture firms. About twenty had taken meetings. We pitched relentlessly, refining the message each time, adjusting for feedback, chasing leads that led nowhere. The effort was grueling. Eventually, Mike burned out. He had emotionally checked out of the roadshow process altogether.

But Ujwal and I couldn’t quit. We rewrote the pitch in our own voice—grounded in data and facts, told with passion. We emphasized the strength of the product, the real traction we had with enterprise customers, and the vision that drove us to build it all in the first place.

Then came our shot.

Chapter 4: The Pitch of a Lifetime

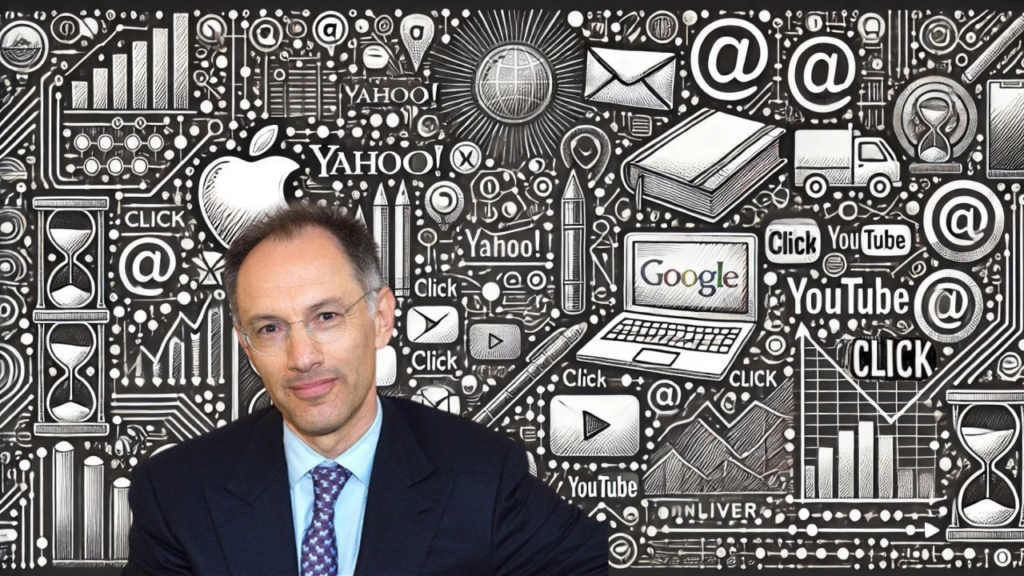

Then, a miracle: the venerable Sequoia Capital said yes to a meeting.

And not just anyone a Sequoia said yes—Mike Moritz himself said yes. By then, Moritz was already legendary. His internet company investments included Google, Yahoo!, PayPal, Webvan, YouTube, eToys, and Zappos. Alongside him sat Pierre Lamond, another titan of Silicon Valley. Lamond had been behind investments in Vitesse Semiconductor, Redback Networks, and Plumtree, and had helped shape National Semiconductor into an industry force. The two partners were accompanied by a couple of sharp analysts, note pads ready.

We gave it everything in the first pitch. Moritz was engaged, leaning in, asking questions. Lamond was more measured but clearly intrigued. The technology landed. The customer traction landed. They saw potential. We walked out of that first meeting buzzing.

A second meeting was scheduled for the following Monday— “deal day,” as we called it. Back at HQ, though, things were dire. Accounts receivables were stalling. Cash was dangerously low. We had already laid off staff. If Sequoia passed, we might not survive.

The second meeting went deep: product architecture, customer use cases, sales funnel strategy. Moritz was probing but encouraging. But at the end, he noted: “It would help to have the CEO present.”

We scheduled the third and final meeting. This one was it. We knew the full partnership would be there. Mike, our CEO, was required.

Ujwal and I rehearsed obsessively. We had the flow down cold. The product narrative. The origin story. The tech architecture. Customer logos and proof points. We were ready.

Mike declined rehearsals. “I know the business,” he said. “I’ll be ready.”

We arrived early at Sequoia’s Sand Hill Road offices. The conference room was classic Sequoia—minimal but elegant, precise, focused. Every partner in the firm sat at the long table.

Mike was nowhere.

Ujwal and I exchanged glances. We were horrified, but the show had to go on. After five tense minutes, Moritz signaled us to begin.

We launched in—just like we practiced. It flowed. The story was tight. The technology was visionary. We wove in endorsements from big-name clients. Momentum was building.

Then the doors opened.

Mike entered, sweaty and breathless. “Traffic,” he mumbled. He took the floor. His commentary was… fine. Off-script, but solid. It was survivable.

Then came the final question from Moritz.

“We always close with one question,” he said. “When you get the money, what are you going to do next?”

Mike paused. One beat. Two.

Then: “We are gonna just ROCK!”

The energy in the room evaporated. Polite smiles. Quiet nods. We were dismissed.

The next morning, the dreaded call came. Mike, barely holding it together, delivered the news:

Sequoia passed.

Chapter 5: Burning Down the Clock

After the Sequoia rejection, silence fell across the office. I remember sitting in the corner office with Mike, the blinds half drawn to block out the unforgiving Bay Area sun. Neither of us said much. The weight of it hung in the air.

Then Mike leaned back in his chair, closed his eyes, and said quietly, “We’re going to miss payroll.”

It was happening. We still had customers. We still had a revolutionary product. But we were out of time. Accounts receivables were locked up in a cascading financial panic as the dot-com world started wobbling. We couldn’t wait for payments. We couldn’t count on miracles.

Enter Ed—our primary investor. Ed was a grizzled veteran of financial street fights. He wasn’t betting on us out of sentiment. He saw a valuable piece of IP that didn’t deserve to be buried in the wreckage of a failed startup. He wired in a $2 million bridge loan—just enough for maybe eight more weeks of life.

With that slim window, Ujwal and I went back into the trenches.

That’s when we were introduced to a small company based in the Midwest. They had been building a complementary analytics layer and claimed to have caught the attention of Venrock—the venture arm of the Rockefeller family and behind such technology greats as Intel and Apple and so many more brand names. The pitch was simple: combine their analytics with our infrastructure platform and we’d have a more compelling, end-to-end story.

We were skeptical, but desperate. We worked closely with them to craft a merged vision. The pitch we produced was clean, honest, urgent. We hit send.

And then the improbable happened.

Venrock responded.

The partner assigned to the deal had once worked as a senior consultant at Arthur Andersen—the very same firm where I had cut my teeth years earlier. We shared war stories. The analyst on the deal knew one of my close friends. The human connections clicked.

Pitch one: green light.

Pitch two: nailed.

Pitch three: scheduled.

But then came the condition.

Venrock wanted a new CEO. Not just any CEO—but someone from IBM. A proven executive. A seasoned operator. Someone they trusted.

We swallowed hard. Mike saw the writing on the wall and stepped aside—reluctantly, but with grace. Ujwal and I knew this was our only path forward. We had to play along.

The third pitch was presented with the new IBM executive front and center. He had the look, the pedigree, the polish.

And just days later, we got the call: Venrock was in. They would lead the round. iMinds Ventures in San Francisco would co-invest. We had a real board now, with a serious independent director—Mike McCloskey, former CEO of Genesys and Kana Software.

The due diligence was deep and exhausting, but we passed. The green light was given.

The company was saved.

Chapter 6: The Deal

Everything was moving. The due diligence process was deep, detailed, and relentless—but we passed. The term sheet from Venrock was in hand. It was real. It was happening.

And then, on the morning of September 11, 2001, the world stopped.

I had flown into Raleigh-Durham, arriving at 1:00 a.m. to present NetBrowser at the Uptime Institute’s Disaster Recovery Conference. It was surreal timing. By breakfast, I was mid-speech when the first pager buzzed. Then another. Then another. A gasp echoed through the room— “Oh my God!”

Someone made the announcement: a plane had hit the World Trade Center. The conference ended instantly. I was stranded with other attendees, most from major banks and financial institutions tied to New York. I watched, live, as the second plane struck.

Calls started coming in.

After some hours, I knew friends were missing. My wife and I had built a network of friends in finance over the years—many from her time in investment banking. We had attended countless industry weekends in places like Pebble Beach with the Securities Industry Association. It felt impossible that any of them could be gone.

Just three weeks earlier, we had dinner with Paul Sloan, my wife’s young trading desk assistant from San Francisco. He was off to live his dream on a New York trading desk. He’d taken a job on the 82nd floor of the South Tower at the World Trade Buildings.

Paul was on the phone with his father in Marin County, deciding whether he should leave after the first plane hit. He chose to stay. Eventually the call went dead as the fire rages below. The South Tower was the first hit and the first to collapse. To this day, that was the only funeral I’ve ever attended without a body.

In total, six people in our immediate network were killed—some in the towers, one on the plane that hit the Pentagon, and another in the field in Pennsylvania. I would later learn that the husband of one of our business contacts from APC, a company we worked closely with, was among the dead.

I was stranded for a week on the East Coast before returning home to my wife and our newborn child. But NetBrowser still had to go on.

Thankfully, none of our team in New York was lost. Everyone had been accounted for.

The fate of the Venrock deal hung in suspension. The financial world was reeling. Planes were grounded. Markets were closed. It seemed like everything might collapse.

And yet, two weeks after the attacks, the deal closed.

We raised $12 million.

At a time when no one was funding anything, we were the only startup in Silicon Valley to close a round in Q4 of 2001.

It was unprecedented. It was unbelievable.

It was our last-second escape.

Chapter 7: The Infiltration

But what arrived after the wire transfer wasn’t celebration. It was infiltration.

Some very strange characters started showing up—people we hadn’t hired, hadn’t vetted, and couldn’t control. First came Peter—a man who, to this day, calls himself a co-founder of NetBrowser, though he was not. He took the title of CTO and quickly assembled his own clique. Then came Chad—a charming but erratic salesman with a sociopathic edge. They moved in like a pack.

It didn’t take long to realize they didn’t want us there. Not me. Not Ujwal. Not anyone from the original NetBrowser team.

The camaraderie we’d built over years of shared struggle vanished overnight. In its place: turf wars, gossip, and intimidation. What was once a tense, but bonded startup had become something else entirely—a company of gangs.

One afternoon, I was in my office working on slides for a board meeting when Chad and Peter walked in, uninvited. Chad leaned in, grinning, and said:

“I practiced with my Desert Eagle (a .50-caliber handgun) this weekend. I used a picture of your face for the target. I’m accurate.”

I didn’t respond. I couldn’t. The air in the room had turned leaden.

Another time, outside the office where Peter and his gang took their ritual smoke breaks, he turned to me and said, loud enough for everyone to hear:

“If you don’t fall in line, I’m going to put your mouth on the curb and kick the back of your head.”

They all laughed. I didn’t.

I didn’t know how to operate in this environment.

And yet—I stayed. Too long. I still believed in the product. I had invested years of my life. And we had just survived the crucible of financing. I didn’t want to walk away.

Then came the setups.

Someone told the CFO I kept a bottle of bourbon in my desk. I didn’t.

The new VP of Business Development told the CEO—someone I considered trusted—that I had lit a bag of dog poop on fire on his front porch. He said he saw me do it. I hadn’t. I never would.

But the lies spread like smoke. And the smoke choked the company.

Meanwhile, all the deals Chad supposedly had in the pipeline—military contracts, partnerships that required lavish “entertainment” trips to Tijuana—failed to materialize. While they chased illusions, the real NetBrowser sales pipeline began to wither. The product was no longer the focus. Image had replaced integrity.

I stopped sleeping. My health declined. At home, I had a newborn. At work, I had a war zone.

And then one day, the CEO asked for a meeting. I walked in, knowing it was over.

I was pushed out painfully. Ujwal held on a little longer. It felt personal with all the drama that had preceded, but it eventually became clear that this was a cost move to reduce burn—and I was near the top of the payroll.

But we both knew it was over.

Epilogue: The Echo

NetBrowser limped along for a while after our departure. The core platform faded. But like the roots of a tree cut down too soon, our work continued to spread underground.

In 2003, NetBrowser was sold to a strategic investor. The name disappeared and was replaced by Modius. But the technology we built lived on—and that matters to people who love creating products the way we did.

Ujwal went on to build a real-time, nationwide biosensor monitoring platform for the U.S. government, using the same core architecture we had pioneered at NetBrowser. The embedded agent we had designed to live on so-called “dumb” machines? That concept evolved into what the world now knows as the Internet of Things.

The real-time, distributed database architecture we built years before it had a name would go on to precede what the tech world eventually called Big Data. Big Data became a market worth hundreds of billions of dollars and changed the nature of computing forever.

We were early. We were right. But we were just a few years too soon.

As for me, I went on to lead other companies—some of which went public, some were acquired, and some didn’t make it. But none of them ever matched the raw belief, the relentless energy, or the sheer audacity we had at NetBrowser. That wild certainty that we were building something the world would one day need.

And we were.

The company just didn’t live long enough to see it.

But ask any of us—Ujwal, Marc, the engineers, the original team who toiled through the nights—and we’ll all say the same thing:

We did rock.

And we’d do it all over again.

I have written this story with all the love, the passion, the lessons for the former startup crew at NetBrower. I do hope we somehow, somewhere may rock together again. ✌️🫶🤟